The benefits of using Amazon FBA are evident - with their motto, “you sell it, we ship it” an example of how simple they have made it for you to launch a thriving business using their fulfillment services. But what happens after the sale is made and the product is sold? How do you know your efforts are worth the time, energy, and money you have put in? At the end of the day, if you’re not making a profit, you have some work to do. This is where accurate accounting and bookkeeping are so important. Whether you’re a complete novice or an experienced Amazon seller, follow our guide below to get your books in order and ensure your Amazon-driven business is around for years to come.

1. Basic Bookkeeping Principles

Bookkeeping can be a daunting task, especially if you have a high volume of sales. But if you approach it with regularity, and build it into part of your daily routine, you’ll find it much more manageable. As an Amazon FBA seller, here is a list of some of the key accounting information you may need to keep track of:

Accounts Receivable

This is the money due from your customers to you. For every product you sell, unless you receive payment upfront, you will have “receivables” that you will need to monitor to ensure your money comes in on time. Keeping this in order means your cash flow remains healthy and allows you to forward plan for future inventory purchases or other expenses.

Accounts Payable

What you owe your suppliers. While it can be disheartening to see all the money you need to pay others, having clarity of what is due and when helps you keep your payments on time, and also means you’re less likely to pay someone twice. In some cases, early payment of invoices can lead to discounts too!

Inventory

Your bread and butter for Amazon FBA. How many products do you have in stock? How fast are you selling them? And when do you need to order more from your suppliers, to ensure you meet demand? Your products should be carefully accounted for and monitored so that you are never caught short. Tracking your seasonal sales trends is a good way to predict how much stock you will need for coming months, especially heading into the festive months when sales typically increase.

Purchases

Any business-related purchases where you pay upfront for the goods should be accounted for. This can include office supplies, professional subscriptions (e.g. organization memberships), equipment such as computers or phones, and even travel, meals, and entertainment. Purchases are a key part of working out your Costs of Goods Sold, and should be subtracted from your sales to determine profit.

Loans Payable

Did you take a loan to get your business off the ground? Whether you borrowed money for products, equipment, or other business essentials, you’ll need to record exactly how much you borrowed, from whom, what is currently owed and when your payments are due.

Sales

We all love to see our revenue coming in, and it’s important to keep a clear record of these incoming sales. Not only is it helpful for knowing what cash you have available, but it also allows you to get a clear picture of where your business is at now, and where it is heading.

Payroll

Not all Amazon FBA sellers have employees, but if you do, you’ll need an accurate and up-to-date account of all payroll expenses to ensure you meet all necessary government and tax requirements.

Owners’ Equity

If you’re a sole trader, this is simply a record of how much of your own money you put into the business. If there is more than one owner, you’ll need to record everyone’s financial input so that everything is above board regarding business ownership.

2. Accounting and Bookkeeping Software Options

Fulfilment by Amazon streamlines the selling process, and eliminates some of the above accounting areas for online businesses. However there is still plenty for you to keep track of, and as such, you can spend a lot of time staring at numbers and trying to make sense of it all. Having a reliable accounting system is, therefore, a must-have for any Amazon seller, but which one fits your needs? Quickbooks Online and Xero are two of the best options on the market, and we’ve detailed their merits for you below:

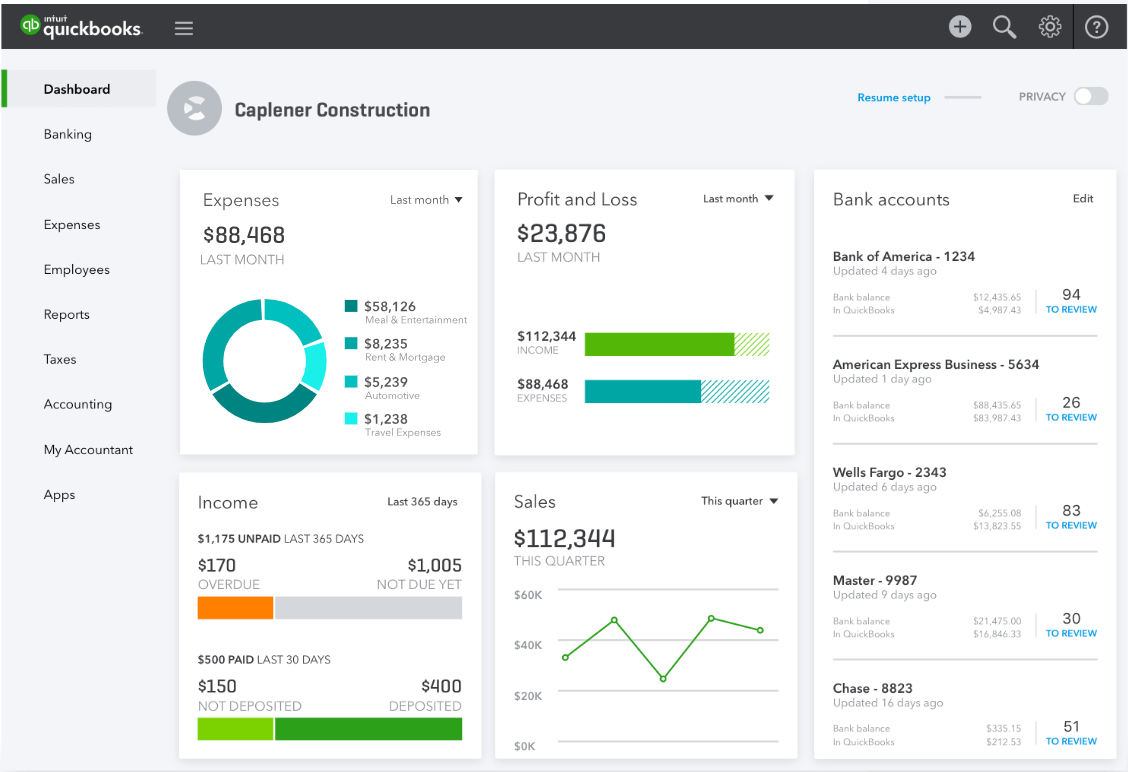

Quickbooks Online

- Works for businesses of all sizes and types, including Amazon businesses.

- Accountants know and understand Quickbooks Online - it’s an industry leader, and has been around for a long time.

- Cloud-based - your Amazon business is online, so having your accounting and bookkeeping online makes a lot of sense.

- Relatively low learning curve - while it is a robust accounting system, if you’re looking to create invoices, track your expenses and sales, and run simple financial reports, Quickbooks Online is a system you can pick up quickly.

- Simple Inventory management - though not as advanced as other systems, Quickbooks Online offers basic inventory management to help you keep track of your stock.

- Integration with other software - Quickbooks Online integrates with many 3rd-party Amazon FBA support systems, so you can build them in to have complete control of your business.

Click here to visit Quickbooks website.

Xero

- Versatility - as with Quickbooks Online, Xero is suitable for all business types and businesses and sizes, and is particularly good for Amazon businesses.

- Simple user interface - usability is Xero’s strength, and makes it easy to learn and use no matter what accounting experience you have.

- Strong inventory management - Xero beat Quickbooks Online to this, and as such it has better options for tracking and managing your Amazon inventory.

- Multiple add-on integrations - like Quickbooks Online, Xero has a solid library of add-ons which you can plug into, including A2X.

Click here to visit Xero website.

Both of these options offer everything an Amazon seller needs to keep their accounts in order, with the main differences coming down to usability and functionality. Accountants are more familiar with Quickbooks Online, but Xero is not far behind. Both offer a trial period, so give them a test and see which one suits your needs.

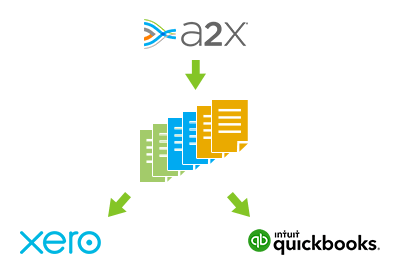

3. Accounting Tool Spotlight - A2X

We mentioned A2X integration already, and with good reason. A2X is an automated solution, aimed at easing the management of your Amazon transactions and information. A2X takes your Amazon settlement file and breaks it down, reorganizing the data into summaries of your revenue, expenses (including Amazon’s charges), and any other vital financial transactions.

From here, A2X creates any invoices or journal entries from the Amazon settlement and sends them to your chosen accounting system. Using A2X, Amazon settlement payments become more visible in your bank account, and are this much easier to reconcile. Automating all of these accounting functions not only takes the difficulty out of making sense of your bookkeeping, but also frees up time for you to focus on the growth and well-being of your business.

If you’re looking to tighten your grip on your finances, the above accounting principles, tools, and systems are a great place to start. Amazon FBA has made online selling much simpler, and your bookkeeping should be the same. This blog only scratches the surface of accounting though, and if you’re still confused, or your business has grown to a level where you can no longer manage it in-house, we’re here to help. Whether you’re looking for some sound accounting advice, or a full bookkeeping partner, please get in touch with our helpful team today!

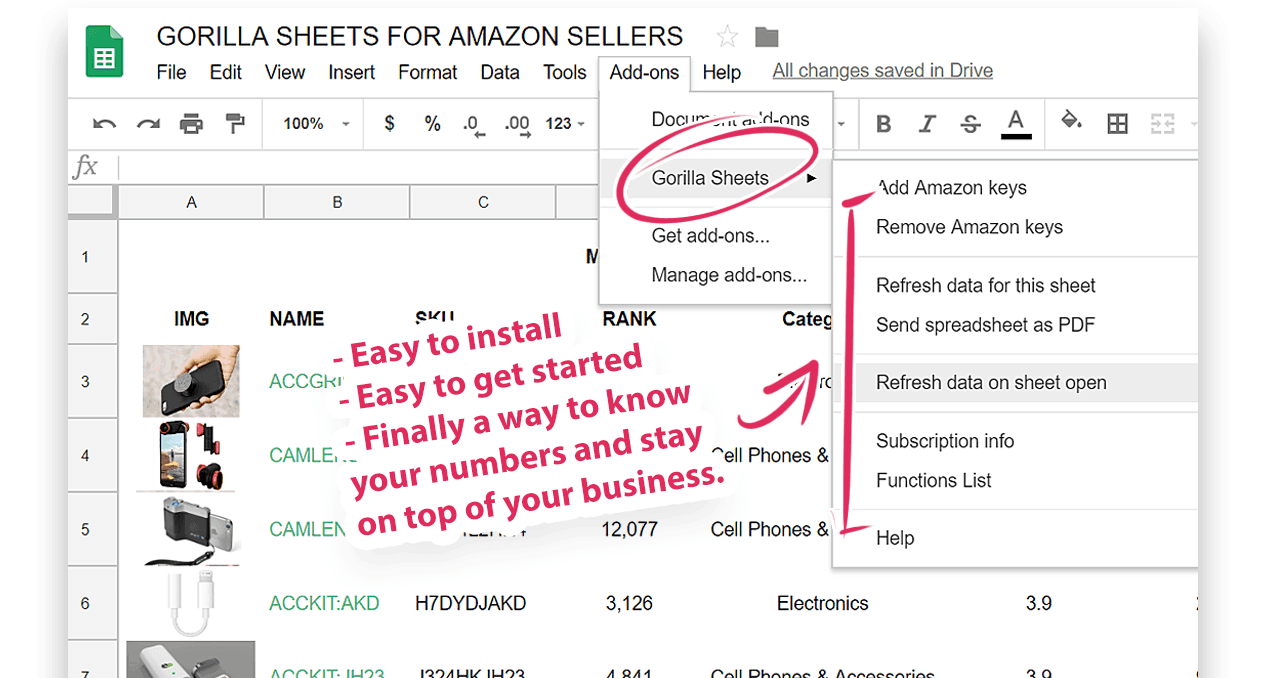

4. Gorilla ROI | Amazon FBA Spreadsheet

Connect your Amazon Seller data to Google sheets and stay on top of your FBA business with Gorilla ROI. This neat little tool is a Google Sheets add-on that functions the same as any Google or Excel formula when enabled.

Users are able to easily access key metrics such as best and worst-performing products as well as which products are gaining sales traction so users can better prepare. The Gorilla ROI team has done the heavy lifting, creating templates that you users gain access too upon signing up.

Below is a list of users who are a good fit for Gorilla ROI:

- Mainly utilize FBA

- Wanting to streamline workflows through automation

- Data-Driven decision making

- Already working in Google Sheets to run reports & calculations